city of richmond property tax calculator

If you have documents to send you can fax them to the City of Richmond assessors office at 804-646-5686. These agencies provide their required tax rates and the City collects the taxes on their behalf.

Download Return On Marketing Investment Romi Worksheet Investing Marketing Program Marketing

Other Services Adopt a pet.

. The basic rate for each business each location annually is 23810 per APN parcel. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Property Tax Vehicle Real Estate Tax.

Real Estate and Personal Property Taxes Online Payment. Are Dental Implants Tax Deductible In Ireland. Parking tickets can now be paid online.

For example entering W0210213 will display the list of all Parcel IDs starting with. These documents are provided in Adobe Acrobat PDF format for printing. If you cannot find your assessment notice property owners can visit wwwmpacca and select the Property Owners option at the top menu bar then click on AboutMyPropertyTM or call Access Richmond Hill at 905-771-8949.

City of Richmond Assessor City of Richmond Assessor. Restaurants In Erie County Lawsuit. Finance and Economic Development Standing Committee Meeting - May 19 2022 at 1.

Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in. Box 250 40 Richard R. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes.

Personal Property Registration Form An ANNUAL. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Box 4277 Houston TX 77210-4277.

Opry Mills Breakfast Restaurants. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Partial Parcel ID may be entered but at least 8 digits should be entered in order to activate the auto suggestion.

The propertys Parcel ID should be entered such as W0210213002. The median property tax on a 23560000 house is 247380 in the united states. Majestic Life Church Service Times.

City of Richmond 2019 and newer property taxes real estate and personal property are billed and collected by the Ray County Collector. Pay Your Parking Violation. Demystifying Property Tax Apportionment httpstaxcolpcocontra-costacaustaxpaymentrev3summaryaccount_lookupjsp.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. 815 am to 500 pm Monday to Friday. This utility allows a person to interactively search the City of Richmond real property database on criteria such as Parcel ID Address Land Value Consideration Amount etc.

Call 804 646-7000 or send an email to the Department of Finance. Actual property tax assessments depend on a number of variables. Search by Parcel IDMap Reference Number.

City of Richmond adopted a tax rate City of Richmond City Hall 402 Morton Street Richmond TX 77469 281 342-5456 Website Design by Granicus - Connecting People and Government. The City of Richmond will be hosting the Juneteenth Family Day and Festival on Saturday June 18 2022. Richmond Property Tax Calculator.

Additional fees may apply. Property Tax Appraisals The City of Richmond Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property. City of Richmond Real Estate Search Program.

For information and inquiries regarding amounts levied by other taxing authorities please contact them directly at. Skip to Main Content. Richmond real estate prices have not changed significantly from November 2019 to November 2020 and the average price of a house in Richmond is 972K.

Loading Do Not Show Again Close. The following video provides a simplified explanation of the relationship between your assessment value and your property taxes. Richmond Property Tax Calculator.

Click Here to Pay Parking Ticket Online. WOWA Trusted and Transparent. Informal Formal Richmond City Council Meetings - May 23 2022 at 400 pm.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. Census Bureau American Community Survey 2006-2010. Restaurants In Matthews Nc That Deliver.

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Municipal Finance Authority 250-383-1181 Victoria Property Assessments. Personal Property Taxes are billed once a year with a December 5 th due date.

Redistricting 2020 Census. To pay your 2019 or newer property taxes online visit the Ray County Collectors websiteAll City of Richmond delinquent taxes 2018 and prior must be paid to the City of Richmond Collector prior to paying 2019 or newer property taxes to the Ray. The results of a successful search will provide the user with information including assessment details land data service.

Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. Calculate your property taxes due in Richmond Hill. All property owners in richmond hill must pay their property taxes.

Greater Vancouver Transportation Authority TransLink 604-953-3333. Every ten years local governments use new census data to redraw their district lines to reflect how local populations have changed. Parking Violations Online Payment.

You can call the City of Richmond Tax Assessors Office for assistance at 804-646-5600. The Richmond Rent Program requires all Landlords maintain an up to date business license for each rental property they operate within the City of Richmond. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Please call the assessors office in Richmond before you send. Davis Drive Richmond Hill. City of richmond maintenance operations 05254100 value.

3 Road Richmond British Columbia V6Y 2C1 Hours. This property tax calculator is intended for approximation purposes only. 900 East Broad Street Room 802.

Property taxes are calculated based on the assessment values set by BC Assessment.

New York City Property Tax Rate Is It Worth Selling

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

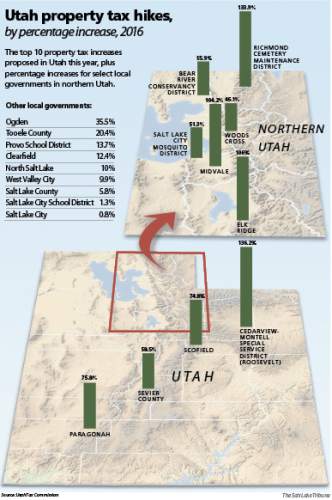

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

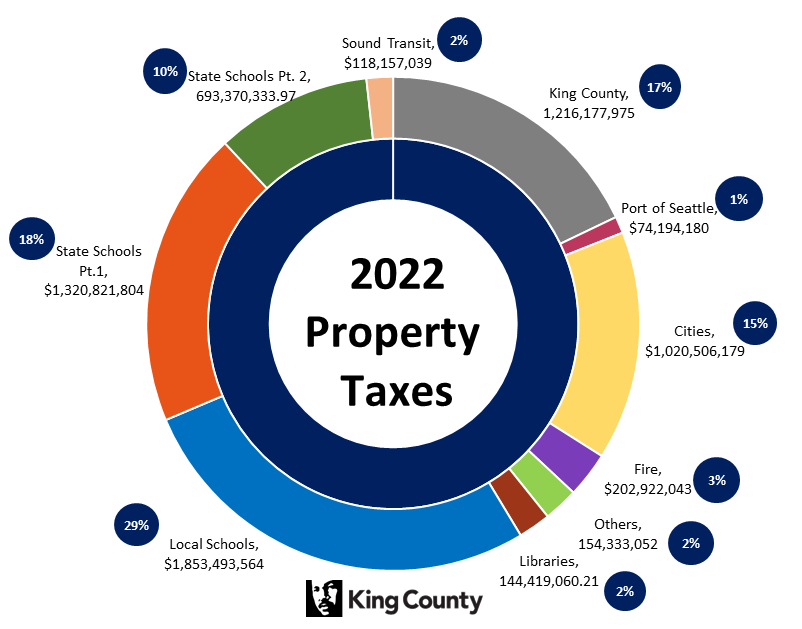

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Virginia Property Tax Calculator Smartasset

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Markham Property Tax 2021 Calculator Rates Wowa Ca

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

Civic Innovators Share Ideas On Shaping Communities In New Knight Cities Audio Series Eco City City Sustainable City

Virginia Property Tax Calculator Smartasset

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now

This Ontario Resort For Sale Has 6 Villas Is Like Living On The Mediterranean Sea In 2022 Vacation Living Resort Mediterranean Sea

New York City Property Tax Rate Is It Worth Selling

A Huge Log Cabin Is For Sale It S Like Living In A Luxury Chalet 30 Minutes From Calgary In 2022 Dream House Chalet Log Cabin

Tax Information City Of Katy Tx

Issue 1 The New York City Property Tax System Discriminates Against Residents Of Majority Minority Neighborhoods Tax Equity Now