are hearing aids tax deductible in australia

Other hearing assistance items that are deductible include televisions and related accessories that amplify. Payments from your regular income for preventative medicine treatment surgery dental care and vision care may be deducted although you may not deduct spending on.

Are Medical Expenses Tax Deductible

In fact the savings includes hearing -related costs.

. You may still be eligible for this offset for income years from 201516 to 201819. A single person with a. Hearing aids like most medical expenses are sometimes tax-deductible reducing the overall outlay.

Hearing aids are most certainly a medical expense that is tax-deductible in Canada. By deducting the cost of hearing aids from their taxable income wearers could reduce. Income tax rebates for hearing aids If you earn an income and pay income tax you will be able to claim a tax offset for out-of-pocket costs on hearing aids expenses after other subsidies.

A single person with a taxable income of less than 88000 can claim 20 of net medical expenses over 2162. Medical Expense Tax Offset Thresholds. If you dont currently spend over 10 there are other ways you can.

91-9899437202 India 1-800. The net medical expenses tax offset is no longer available from 1 July 2019. At Least Hearing Aids Are Partly Tax Deductible According to Health Hearing and other sources we consulted the following applies to hearing aid deductibles for the 2020 tax.

Now if the answer to are hearing aids taxable is no for you there are still options on the table aside from your tax returns. In many cases hearing aids are tax-deductible. The short and sweet answer is yes.

Physician visits prescriptions for eyeglasses contact lenses false teeth hearing aids and appliances Can You Claim Medical Expenses On Tax. Are hearing aids tax deductible. Davide Costanzo chairman of the Moore Australia Tax Committee notes that expenses of a private nature such as meals tea and coffee toilet paper clothing and gym.

Deducting the cost of hearing aids from your taxable income can lower the amount you pay for hearing aids by as much as 35 percent. However there are saidsome things to consider and. Hearing aids batteries maintenance costs and repairs are all deductible.

Find out the things to keep in mind while considering hearing aids as a tax deduction. Yes hearing aids are tax deductible. Examples would include.

Medical expenses tax offset. Hearing aids are tax deductible if you itemize your medical deductions on your federal income taxes.

Are Hearing Aids Tax Deductible In Canada Ictsd Org

Latest Information About Hearing Aids Tinnitus Hearing Loss And Gadgets At Pristine Hearing Pristine Hearing Perth Hearing Aid Hearing Test And Tinnitus Specialists Adults Children

What Medical Expenses Are Tax Deductible In Australian Ictsd Org

Latest Information About Hearing Aids Tinnitus Hearing Loss And Gadgets At Pristine Hearing Pristine Hearing Perth Hearing Aid Hearing Test And Tinnitus Specialists Adults Children

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Are Medical Expenses Tax Deductible In Australia Ictsd Org

Science Of Healthy Hearing Podcast Ear Science Institute Australia

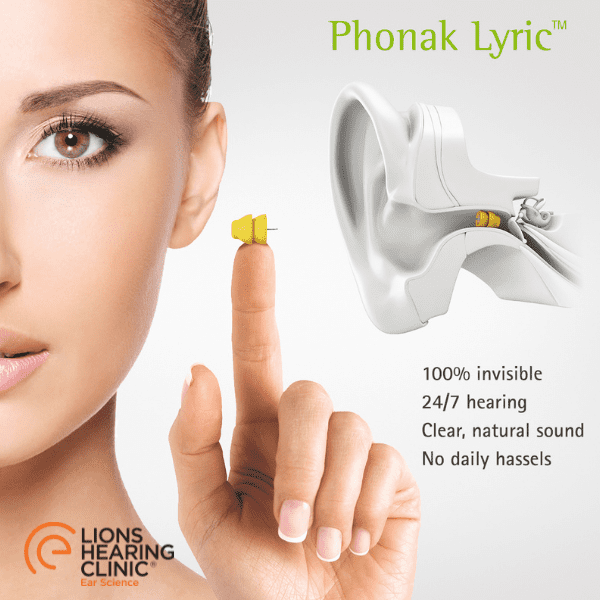

Hearing Aids Ear Science Institute Australia

Hearing Aid Funding Options Pristine Hearing Perth Hearing Aid Hearing Test And Tinnitus Specialists Adults Children

Can I Claim Hearing Aids On My Income Tax Canada Ictsd Org

Hearing Aids Ear Science Institute Australia

What Medical Expenses Can Be Claimed On Tax Return Canada Ictsd Org

![]()

Are Hearing Aids Tax Deductible Earpros Ca

Are Medical Expenses Tax Deductible Australia Ictsd Org

Costco S New Ks10 Hearing Aid Has Arrived At 1 399 Per Pair

Costco S New Ks10 Hearing Aid Has Arrived At 1 399 Per Pair

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

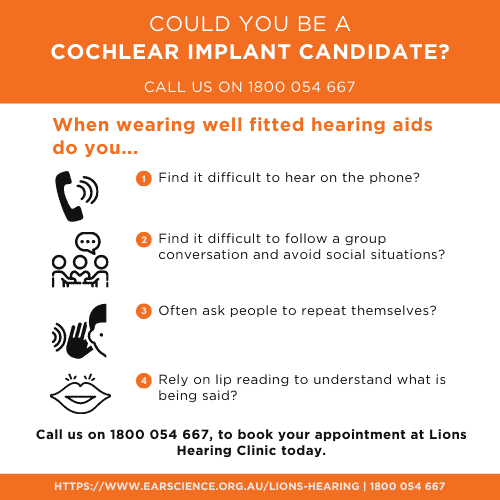

Hearing Implants Journey Ear Science Institute Australia

Are Hearing Aid Batteries Tax Deductible In Canada Ictsd Org